Welcome to CMBA-BC!

Since 1990, the Canadian Mortgage Brokers Association – British Columbia (CMBA-BC) has been working on your behalf to support and enhance professionalism and ethical standards within the mortgage industry.

Member BenefitsJoin NowCMBA-BC news in your inbox.

NEWS, ALERTS AND ADVOCACY

New Program: First Home Savings Account

To assist first-time home buyers, the federal government brought into existence (as of April 1, 2023) the First Time Home Savings Account (FHSA).

Read the bulletin here

New Responsibility for Mortgage Brokers re Non-Canadian Clients

CMBA-BC has reviewed regulations and summarized key areas of interest to mortgage brokers. Released: December 23, 2022

Read the analysis here

BCFSA – HomeBuyer Rescission Period(HBRP) Information

CMBA-BC has gathered key information on the HBRP for our members and the broader community. Released: November 10th, 2022.

Cullen Report – Points of Interest for Mortgage Brokers

CMBA-BC has analyzed the Cullen Commission’s Report, and made references to any recommendations which may impact mortgage brokers. Summary released: June 20, 2022

Read the analysis here

BCFSA Cooling-Off Period Consultation

CMBA-BC has prepared a submission on ‘cooling-off periods’ and other real estate consumer protection measures which was submitted earlier this year.

Read the submission here

EDUCATION & EVENTS

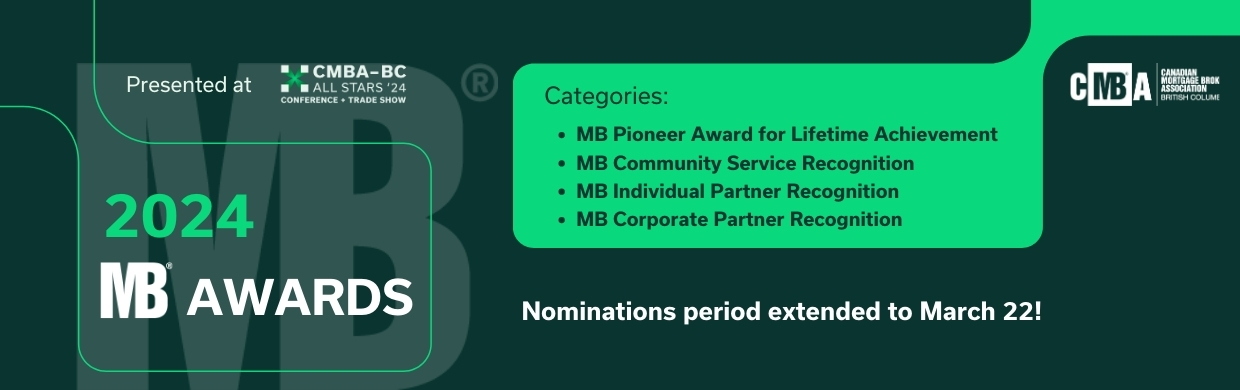

2024 Conference & Tradeshow: All Stars '24

April 15 and 16, 2024 at the JW Marriott Parq!

Early bird registration is now open >>

CMBA-BC Webinars On-Demand

Learn from experts covering a variety of topics (Member-only benefit).

Browse webinars here >>THE CANADIAN MORTGAGE BROKER MAGAZINE

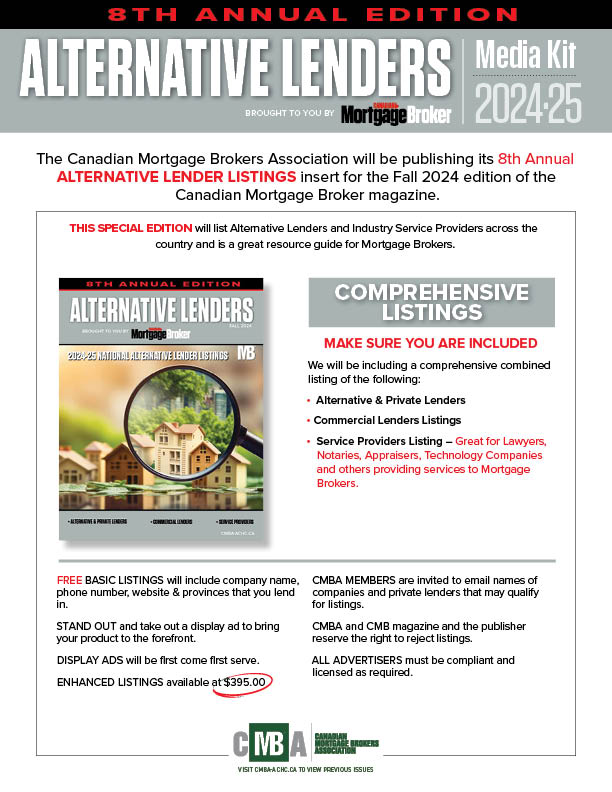

We are excited to bring you the Canadian Mortgage Broker magazine! The CMB magazine is a vital source for mortgage brokers to facilitate knowledge and increase expertise in their given field.

Browse previous issuesRead latest issueThis magazine presents an excellent means of communication within and outside the industry, providing not only a forum for corporations, lenders and service providers to interconnect, but also to deliver the latest news, profiles on elite professionals, feature articles, case studies and insight on hidden trends.